All Bull Markets Must End Badly - This One Is No Different

Summary

- A Trump presidency, albeit drama filled, is great for the economy.

- The debt ceiling is approaching fast.

- The Dow keeps chugging along; longest streak of record highs in over 30 years.

- Interest Rates and China.

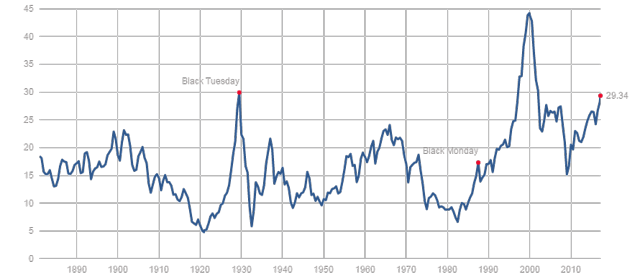

- Valuations - At only 2 points in history has valuation been higher.

Today, we are going to talk about a few different topics. We haven't given much time to posting about macro views, so we will express our concerns here in the next few paragraphs (we promise it will be worth the read!).

It's time to be cautious. We said in a previous

post we were no longer going to talk about the reasons to be bearish. Well… We lied. It is simply impossible to ignore the elephant in the room. It gets frustrating for those being constantly told "This is it. This is the top," or "Stay cautious. Right now is a scary time" We fully understand how one can begin to ignore similar posts. We understand how someone can cry wolf one too many times. Although these are all common issues for bearish analyses, does it make any sense to become complacent because someone's timing is off? Absolutely not. The minute you lose the reality of the data being presented is the same minute you open your account to find the market has tanked.

Those who have followed us since 2015 know we successfully called the November 2015 top, the January and February 2016 bottom, the gold bottom (twice) (also the most recent top), and many successful stock picks such as Western Digital (NYSE:

WDC), Strayer Education (NASDAQ:

STRA), Flowers Foods (NYSE:

FLO), Methanex (NASDAQ:

MEOH), and so on (these posts can all be found at

www.facebook.com/PerceptiveInvestment). That being said, we were obviously wrong about our call for a possible market top in June 2016. Our analysis led us to believe with the effects of Brexit and the upcoming election, we would begin experiencing sell offs. We were right about the Brexit sell off, albeit briefly. However, we have been baffled at the rally that followed. Does this mean we are wrong about our analysis? Not at all. We are simply wrong on timing (something no one can truly predict.) The election of Trump was something seen as statistically improbable. Now, we need to re-analyze what his election truly means.

Let's get to it.

The President Trump Effect

There is no denying the drama that has surrounded President Trump since even prior to the primaries. Most of media sources have been digging their own graves. Does any of that really matter? If the president can avoid any major scandals, we can ignore the noise. Let's talk about policy, which is what really matters.

Going over the Executive Actions, the first is regulation. President Trump has frozen all pending regulations. He has also introduced a "two out, one in" method for creating any new regulations. Regulations have decimated businesses over the last 8 years. This is a large part of the lack of GDP and earnings growth. Now that businesses are no longer going to be handcuffed, this should improve the economy.

The second Executive Action to acknowledge is the doing-away of the TPP. The TPP would hurt the US more than help. Its goal is to tie the United States to as many trade partners as possible. However, the deal hurts US workers, would lose the US millions of manufacturing jobs, and it would do nothing to fix our trade deficit. There were many other issues as well with the TPP, and the US dodged a bad deal on this one.

The

third Executive Action to discuss is the approval of the Keystone and Dakota Access Pipelines. Although there was a lot of noise and drama surrounding DAPL, the emotional rhetoric behind it was substantiated by very little logical reasoning. The pipelines are a great economic boost and will help push the United States to energy independence. Not only that, the pipelines are GOOD for the environment, much to people's disbelief's. The reason being - the pipelines provide a means of transporting oil that is much safer than other means. A study done by the state department during President Obama's term showed that it was

MORE dangerous to the environment to transport via barge or rail than it is via pipeline.

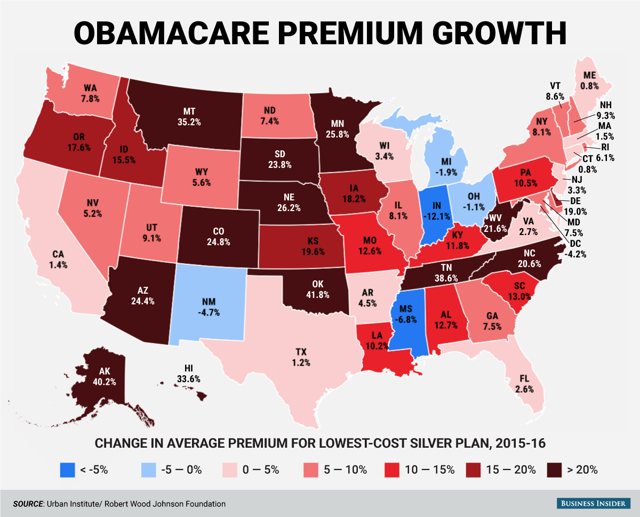

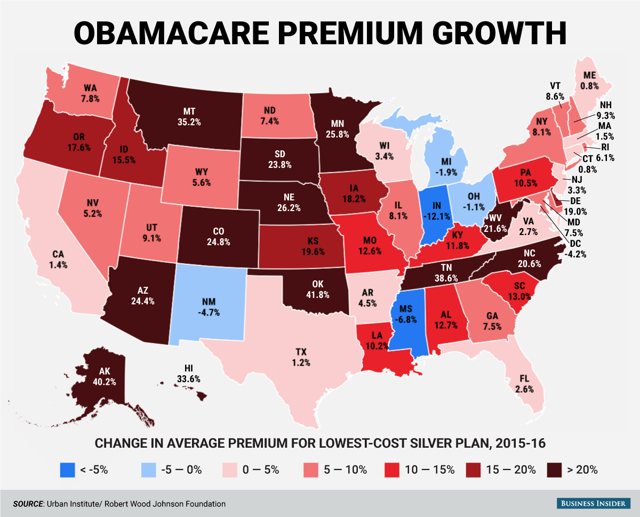

The

fourth executive order that will provide a boost to the economy is the repealing of the ACA (aka Obamacare.) As with anything, there are pros and cons. The intentions of Obamacare were never ill-advised. There are many great benefits for those who can use it like: the preexisting condition law, expanded Medicaid to those who were just outside of the qualifications, and it increased the amount of Americans on health insurance. Sure, all this seems great, but at what cost? The cons GREATLY outweighed the pros. Small businesses have been decimated due to the costs, premiums have doubled and tripled for millions of Americans who now cannot afford to see a doctor, millions of people had their private insurance

CANCELED because the insurance companies could not meet the requirements (what happened to "you can keep your doctor?"), those who didn't purchase insurance were taxed (most likely because they could not afford it in the first place), and it has put a strain on the healthcare system. Personally, I am a United States Marine Corps veteran. I would advise anyone who is pro-ACA to come with me to a VA appointment. The reality is: socialized medicine is detrimental to economic growth and quality of care. A brief example of my experience with the VA urgent care: I needed to be seen due to a severe flu. I wanted to make sure I had no infections developing due to the fact I recently had teeth pulled as well. In a nearly empty waiting room, I sat for 45 minutes to be called back. My first thoughts were "Well at least now I can get treated and go home to lay back down." NOPE. I joined a Vietnam-era vet who had cracked a rib falling down and had an elbow profusely bleeding and an elderly lady who couldn't sit up straight due to being so dizzy. An hour goes by…Not one word from a nurse or doctor. Another hour… A nurse finally shows up to look at the old man. He had already been examined with x-rays and simply needed to be treated. The nurse bandaged his elbow, gave him a prescription for pain, and told him he was free to leave. The old man was clearly still concerned about his ribs. The response to him was "just take it easy next time and avoid strenuous activities for a few weeks." I couldn't believe the lack of concern. Another hour passes and finally, I am told to go to an examination room. Another 30 minutes pass… A nurse knocks on my door and then says, "Oh, I'm so sorry. We thought you were treated already. Let me go get the Nurse Practitioner." Another 15 minutes pass… A different nurse comes in to give me a flu shot and a prescription. I asked, "So… Is that it?" It was. After hoping for a quick treatment, I had been at the VA for over 4 hours for something that took all of 5 minutes. I would NEVER wish government provided healthcare on ANYONE. Is it the personnel's fault for the bad quality? I would say partially, but the root cause is the bureaucracy and hiring process done by the government. The repeal process of the ACA will help alleviate many of Americans' struggles financially, including businesses, as well as their quality of care in the future.

The

fifth Executive Action has to do with taxes. Although President Trump has not signed anything into action, it is being anticipated that he will soon. His

plan is to cut the corporate tax rate from 35% (highest in the world when comparing 1st world countries) to 15%. When President Reagan cut taxes, GDP ended up growing at a rate of over 4%. President Obama never saw above 3% annualized GDP growth, which makes him the first president since Hoover to do so badly. We can be naïve and make excuses and say the president has very limited power. However, that is simply not true when it comes to policy agendas. The president can do a lot when he pushes an issue, which is exactly how Obamacare was passed. President Trump has also announced he wants only a 10% flat tax for the repatriation of companies' cash overseas. Should this happen, companies could bring billions of dollars back into the United States, which would help provide and economic boom. The extra cash can be used to buy new supplies/buildings/etc, be spent on research and development, and overall help create more opportunity for innovation within the United States. Think of Apple (NASDAQ:

AAPL): Apple has a whopping $200 BILLION overseas. Imagine what that cash could be used for here in the US!

Is the President Trump Effect enough to keep us going? Possibly. Now that we have identified what looks to be the reason behind this parabolic rally since November, we can now give ourselves a dose of reality by looking at the bigger picture.

The Debt Ceiling

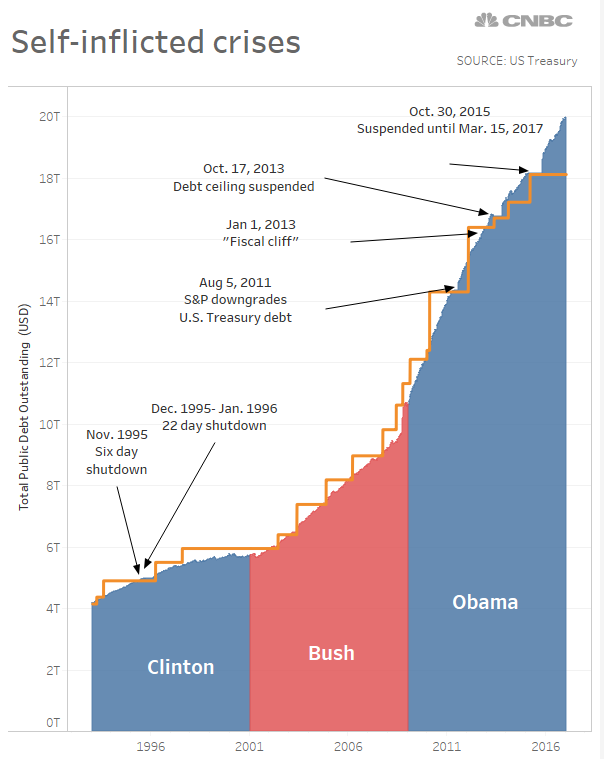

On March 15, congress will have to

deal with our biggest nation threat: the DEBT. We are at $19.9 trillion currently and FAST approaching the $20 trillion marker. Why does this matter? Well, usually it wouldn't. This time IS different. The reason being, this is the FIRST time since WWII that our debt has overcome our GDP (currently 104% of GDP). The thing is, this time, we don't have a multi-country war of millions of men costing trillions of dollars worldwide. Instead, we have a world full of debt-ridden countries just one bad disaster away from default.

Dow Jones Hits Record Close 11 Days in a Row

Late day panic buying sent the DJIA into a

frenzy, which resulted in the longest record streak in over 30 years. On top of this, the S&P 500 and DJIA have not seen a down day of 1% or more in over 3 months! Is this sustainable even in the best of economic times? Is the economy truly worth 12% more than it was in November? I don' believe so. We believe any benefit of Trump's presidency has been baked in over the last few months. The only way to justify the rate of return even possibly continuing would be if something happens as dramatic like Trump's election results. The market was generally overvalued already. We are now at the point of euphoria.

Queen Yellen and Interest Rates

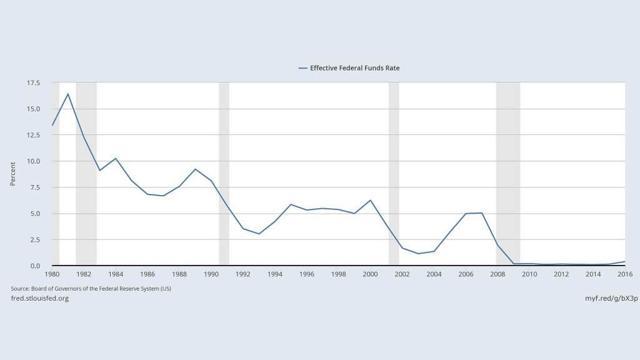

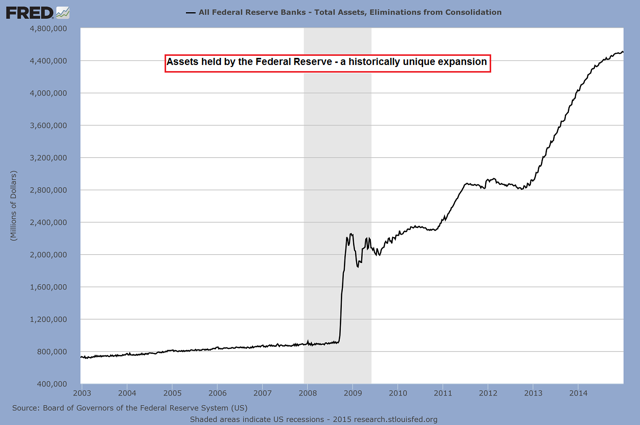

The Fed currently has a 73%

probability for raising rates in March. I am personally ecstatic about the idea. Not because I like when the market implodes due to Yellen crying wolf 1 or 937859 too many times. I am ecstatic because we might actually get to a point where we don't have to live in fear of negative rates, worthless currency, and a broken financial system. Okay, maybe the last point won't happen, but the raise of rates has been needed TERRIBLY. Rates have not been lower and not nearly as low this long in more than a half century. We did what we had to do in 2008/2009 to prevent a world collapse. I do NOT believe we did the right thing in the years following. I believe the FED has induced an asset bubble once again. The FED has too much on their books, and the US taxpayer will eventually pay the consequences.

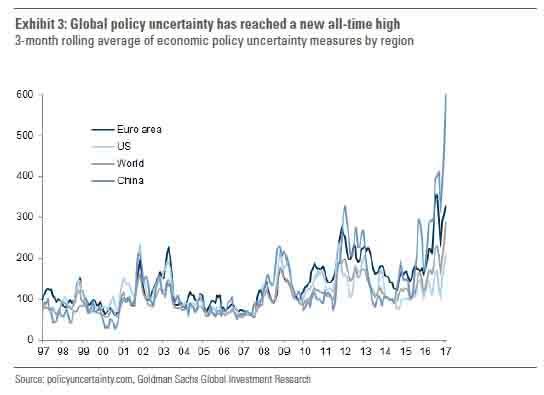

China

How is it possible that China, which is seemingly far more "concerning" at this moment than it was a year ago when fears about Chinese financial conditions and devaluation led to global market selloff and pushed the S&P into correction, has had virtually no impact on risk assets so far in 2017? Either the uncertainty data is wrong, or the market is WILDY wrong. It is hard to say the impact President Trump will have on our relationship with China, but we can say it is concerning.

Last but Most Importantly: Valuations

An

article was put out back in July 2016 about how companies like Alphabet (NASDAQ:

GOOG) and Amazon (NASDAQ:

AMZN) are so disruptive, we need to think of different valuation metrics to judge them. What I take from this is: Valuations no longer matter because we can't measure the impact of disrupting companies. While this is true, Amazon and Alphabet are dominate, what matters are top and bottom lines. It is pretty hard to justify investing in a company whose P/E ratio was over 950 less than 2 years ago. Yes, Amazon can do something like move into online banking or the like and disrupt even more, but why would we ignore valuations over speculation? Top and bottom lines are what make a company a good investment, not speculation on prospects. That isn't to say we should ignore future prospects, either. The main point here is this: We absolutely need to worry about valuations.

The 12 big cap techs of 2000 (led by Microsoft (NASDAQ:

MSFT), Dell , Intel (NASDAQ:

INTC), and Cisco (NASDAQ:

CSCO) saw their combined valuation soar from $900 billion to $3.8 trillion in the 48 months leading up to the March 2000 peak. They plunged to just $875 billion a decade later. Their market cap was reduced by nearly 80%! How are the long term investors of Microsoft from 1998/1999 fairing? It took them 14 years to make a return on investment excluding dividends! Not only this, their accounts were devoured by inflation.

When 2015 ended, the four fabulous fang stocks of Facebook (NASDAQ:

FB), Amazon, Netflix (NASDAQ:

NFLX), and Alphabet gained $500 billion of market cap while the remaining 496 companies in the S&P 500 went DOWN by more than $500 billion. We are talking about 4 companies that essentially kept the market afloat and kicked the bear market farther down the road. Amazon has a current P/E of 172, is trading at 41 times its free cash flow, is worth 20 times its book value, and has had little to no profit margin in the past few years. This isn't meant to be a swipe at Amazon (I actually love the company and its prospects). This is just a reality check.

Summary

In summary, we believe the market is destined to see a bear market in the near future. We fully believe we are on an unsustainable path. In the short term, we may see a small retracement towards some kind of support level (indicated on the charts below.) Longer term, our view is that the US economy will see growth, but unfortunately, that speculated growth has been baked into the current market prices. We believe it is more of probability than a possibility that the US stock market will experience its first bear market since 2009 within the next couple years. As Benjamin Graham says: "All bull markets MUST end badly." The longer the bull market, the steeper the fall. This is now the second longest bull market on record. We will be watching for a break of the "primary trend" as indicated on the weekly chart below. It's going to end, so be cautious.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.